From distress to growth: The residential opportunity

Article10 mins22 August 2024

With new housing starts at decade lows, surging construction costs and builders under pressure, the impact of rate increases and inflationary pressures has created distressed and attractive risk-adjusted opportunities throughout the residential sector – opportunities which have been taken up by the Dexus Real Estate Partnership (DREP) Series.

The cash rate in Australia has increased thirteen times since the start of this cycle, taking it from 0.10% to 4.35%. This period delivered the most rapid increase in Australian interest rates on record. Readjustments across the economy, many of them painful, were inevitable.

We are at a cyclical inflection point. Intensifying capital pressures are forcing the hands of many real asset owners and creditors, including in the residential sector. Their choices are unenviable: pay more for debt or accept less when selling their assets. One way or another, the continuation of elevated borrowing costs and the need for liquidity is forcing action.

For those with access to capital and operational capability, we have entered a period of significant potential and Dexus is well positioned to find and capitalise on these investments amid the disruption.

Dexus’s first opportunity fund, Dexus Real Estate Partnership 1 (DREP1) launched in 2021 and raised equity of A$475 million. Leveraging the Dexus platform, and a trading track record spanning more than 10 years, we have secured 141 transactions to date across the spectrum of real estate investments. The Fund is on track to deliver the target net equity IRR of circa 15%2 .

The second fund in the series – DREP2 – is now open for investment, enabling institutions and private wealth clients to invest directly in this high-performing strategy. First close for DREP2 occurred in June 2024 with equity raised in excess of A$300 million.

The timing is favourable – and investment vintage matters. The data on global opportunistic real estate returns bears this out. The highest-performing investment vintages have historically followed periods of recalibration and disruption. This is precisely what we are experiencing right now. This stage in the cycle offers a rich opportunistic investing environment that is the most attractive I’ve seen since the GFC, but it doesn’t stay this way forever.

The strategy in action: Residential

The demand and supply dynamics in the residential sector are well documented. Over the long term, strong macroeconomic tailwinds, including high employment and population growth, support residential demand. Supply, meanwhile, has failed to keep up. Recent residential construction activity, for example, is below trend, resulting in a significant housing shortfall. Almost two million additional dwellings will be needed over the next decade, a situation that will not be rectified easily or quickly.

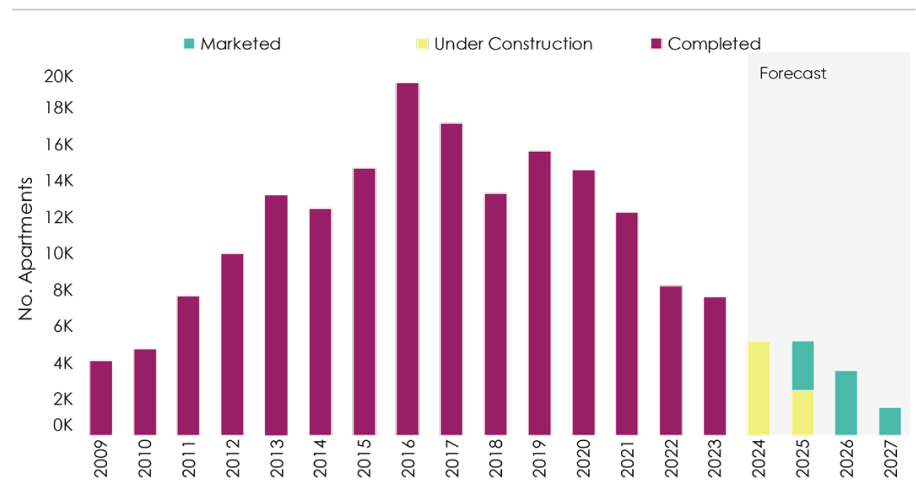

Chart 1 BTS Apartment Supply | Sydney

Source: Charter Keck Kramer

Chart 2 BTS Apartment Supply | Melbourne

Source: Charter Keck Kramer

[1] One of the deals has exchanged and is subject to settlement.

[2] The target IRR is not a guarantee, forecast or prediction. There can be no assurance that the Fund will meet the Target IRR. IRR is presented on a “net” basis and reflects Management Fees, Performance Fees, Fund expenses, taxes and duties borne by the Fund (disregarding any rebates). For the purposes of this calculation, cash flows will be grossed up for any withholding tax and will be increased by the face value of any franking credits or foreign income tax offsets received by the Investor, and Investors will be deemed to have received a distribution of any such amounts.