The five key takeaways from AREIT reporting season HY2025

12 minute read24 March 2025

In the 2024 full year results, we made the case that rates had peaked and that AREIT prices would rise due to the improving operational environment. The recent half year reporting season confirmed those themes, with added colour and, dare we say it, a dash of enthusiasm despite the short-term performance of the index.

Over the six-months to 28 February 2025, the S&P/ASX AREIT 300 Index has returned -1.88% while the Dexus AREIT Fund delivered total return of about -1.38%1.

The recovery of the past year or so still has a way to run. We’re expecting high single-digit total returns in the coming years, delivered with manageable risk. Here are the five key takeaways from the reporting season just ended.

1. Retail a standout performer, office recovery coming

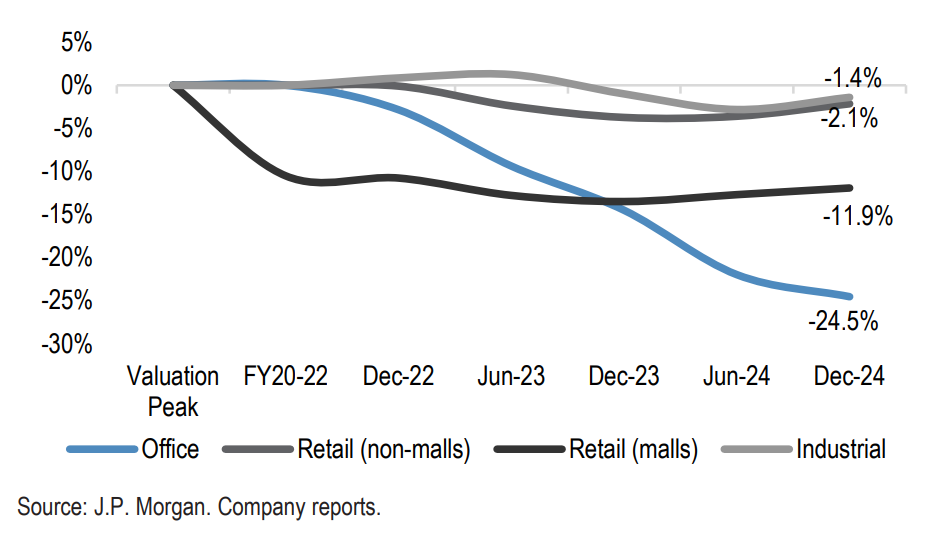

As the chart below highlights, the evidence of recovery is mounting. Of the major property sectors, asset transactions in retail and industrial are occurring above book value, although transactions in the office sector are at a slight discount. But even here, prices are expected to bottom out this year.

Valuation Moves Since the Peak

Let’s look at the recent results by sector.

Retail

From destination malls to convenience retail, there is evidence of higher footfall, with spending noticeably above trend.

This is leading to rent increases above CPI and, unlike the office sector, this is happening without much in the way of incentives. Positive leasing spreads continue and, in some cases, have risen.

Occupancy is also improving, allowing landlords to curate a tenant mix best able to maximise rental tension. Shrinking department stores should help in this regard, releasing more space for discretionary retailers and other better performing categories. Against this backdrop, the collapse of Mosaic Brands barely registered.

With expectations for circa 50 basis points of cap rate compression this calendar year2, we expect substantial valuation increases. With retail supply constrained, this is a sector with the most attractive prospects for income investors over the next 4-5 years.

Office

The office sector is now at cyclical lows with further valuation declines driven by cap rate expansion in the half. Perhaps signalling the bottom, leasing spreads have improved despite over-renting.

This is provoking generous incentives offered by landlords to prospective tenants to upgrade space requirements and location. This is most notable in Melbourne and Sydney, where tenants are moving from suburban and fringe locations to CBDs. Coles, for example, has moved its headquarters from Tooronga in east suburban Melbourne to be adjacent to Southern Cross station in the city.

Brisbane CBD is the best performing office market, with evidence of the popularity spilling over into the performance of its fringe and suburban markets. Melbourne remains soft, driven by the number of under-rented properties in the Docklands precinct.

Industrial

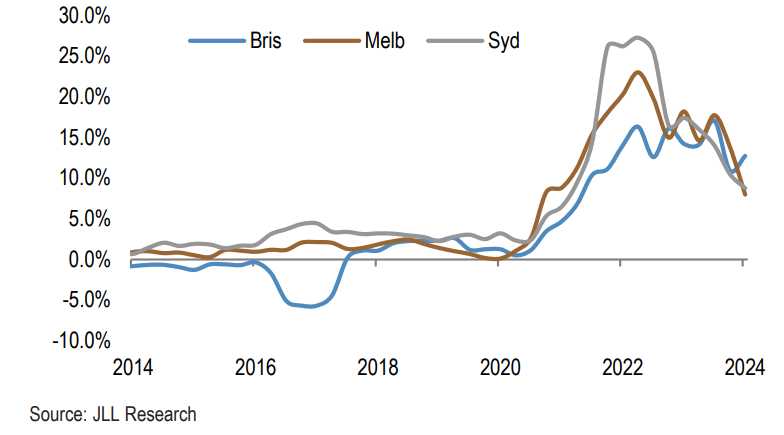

This once booming sector is now well off its peaks, as this chart, displaying prime industrial rents in east coast capital cities, illustrates.

Assisted by under-renting, rental growth and tenant demand is moving closer to long-term historical levels. Nevertheless, supply and demand dynamics remain favourable as vacancy levels remain low compared to long term averages. It should, however, be noted that over the past year to December 2024, the vacancy rate has risen from about 1.1% to 2.5%3.

2. AREITs are through the worst of it

Many AREITs are now in a more confident financial position. As the funding backdrop improves, fund redemption queues are shortening and secondary market transactions are starting to occur at a discount, reducing the number of forced sales.

More AREITs are exploring cheaper capital sources to undertake more deals and fund developments, with Mirvac and Stockland active in this regard. As noted by Centuria Capital, the drop in official interest rates has also spurred interest from retail investors in property syndicates. Among institutions, capital-lite models like partnering and joint ventures are becoming more prominent, especially when compared to pooled funds.

These factors point to what we consider to a greater truth—AREITs are well past the worst of it. This remains a time of opportunity.

3. Many AREITs still trade at a discount

As we argued in Why AREIT investors shouldn’t wait for the starter’s gun - Part 1, despite the recovery many AREITs are still trading at a discount to net asset value. With the cost of capital falling, we expect more mergers and acquisitions in the coming year, should the discounts persist. As well, AREITs are increasingly seeking to play offence themselves, targeting peer or unlisted funds facing cashflow, capital management and/or redemption issues.

Two more factors are at play. The falling cost of capital and the removal of bank hybrids from the market is encouraging more income-style products and initial public offerings focused on income investors. Centuria Capital, for example, is looking to list two AREITs (as well as an LIT) in 2025. This bodes well for the sector.

4. Lower funding costs to power earnings and distribution growth

Interest rate cost assumptions are presently higher than market forecasts. As banks increase their property allocations, bank debt is becoming easier to access. Longer repayment periods are also being offered and bank margins are falling. Funding costs should therefore be lower than previously forecast.

Debt metrics, meanwhile, are securely positioned, although a couple of AREITs, including Abacus Storage King, have indicated future gearing will marginally rise. This is not a concern overall, as debt levels across the sector are well within an acceptable range.

Capital management is now an ever-stronger tailwind powering future earnings and distribution growth.

5. Traditional AREITs remain better positioned

There was a marked increase in the number of AREITs considering data centre opportunities. Goodman Group, which we have previously called the ‘gorilla of the index’, is the best example. It went further, conducting a $4.4bn dilutive equity raising to finance a small fraction of its potential data centre pipeline.

Such developments are capital intensive, high risk and face long lead times. Compared to the stability and reliability offered by rental receipts, or even revenues from funds management, data centre developments offer a higher risk-return profile.

Traditional AREITs that already own rent generating assets are better positioned than those reliant on future large-scale transactions and developments to deliver earnings growth. Conservative income investors should generally stick with the safe and familiar rather than succumb to the allure of something shiny, new, expensive and complicated.

1Net of fees. Past performance is not a reliable of indicator of future performance.

2JLL research

3CBRE Research

Invest in AREITs

The Dexus AREIT Fund (DXAF) is an income-focused property securities fund that invests in a portfolio of listed Australian Real Estate Investment Trusts (AREITs).

Important note: This document (“Material”) has been prepared by Dexus Asset Management Limited (ACN 080 674 479, AFSL No. 237500) (“DXAM”), the responsible entity and issuer of the financial products of the Dexus AREIT Fund (ARSN 134 361 229) mentioned in this Material. DXAM is a wholly owned subsidiary of Dexus (ASX: DXS). Information in this Material is current as at 28 Feb 2024 (unless otherwise indicated), is for general information purposes only, does not constitute financial product advice, has been prepared without taking account of the recipient’s objectives, financial situation and needs, and does not purport to contain all information necessary for making an investment decision. Accordingly, and before you receive any financial service from us (including deciding to acquire or to continue to hold a product in any fund mentioned in this Material), or act on this Material, investors should obtain and consider the relevant product disclosure statement (“PDS”), DXAM financial services guide (“FSG”) and relevant target market determination (“TMD”) in full, consider the appropriateness of this Material having regard to your own objectives, financial situation and needs and seek independent legal, tax and financial advice. The PDS, FSG and TMD (hard copy or electronic copy) are available from DXAM, Level 5, 80 Collins Street (South Tower), Melbourne VIC 3000, by visiting https://www.dexus.com/investor-centre, by emailing investorservices@dexus.com or by phoning 1300 374 029. The PDS contains important information about risks, costs and fees (including fees payable to DXAM for managing the fund). Any investment is subject to investment risk, including possible delays in repayment and loss of income and principal invested, and there is no guarantee on the performance of the fund or the return of any capital. This Material is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives. Any forward looking statements, opinions and estimates (including statements of intent) in this Material are based on estimates and assumptions related to future business, economic, market, political, social and other conditions that are inherently subject to significant uncertainties, risks and contingencies, and the assumptions may change at any time without notice. Actual results may differ materially from those predicted or implied by any forward looking statements for a range of reasons. Past performance is not an indication of future performance. The forward looking statements only speak as at the date of this Material, and except as required by law, DXAM disclaims any duty to update them to reflect new developments. Except as required by law, no representation, assurance, guarantee or warranty, express or implied, is made as to the fairness, authenticity, validity, suitability, reliability, accuracy, completeness or correctness of any information, statement, estimate or opinion, or as to the reasonableness of any assumption, in this Material. By reading or viewing this Material and to the fullest extent permitted by law, the recipient releases Dexus, DXAM, their affiliates, and all of their directors, officers, employees, representatives and advisers from any and all direct, indirect and consequential losses, damages, costs, expenses and liabilities of any kind (“Losses”) arising in connection with any recipient or person acting on or relying on anything contained in or omitted from this Material or any other written or oral information, statement, estimate or opinion, whether or not the Losses arise in connection with any negligence or default of Dexus, DXAM or their affiliates, or otherwise. Dexus, DXAM and/or their affiliates may have an interest in the financial products, and may earn fees as a result of transactions, mentioned in this Material.